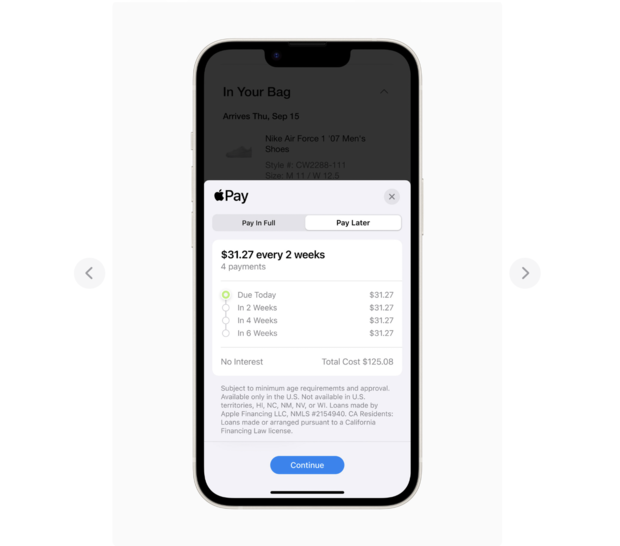

Apple will now let customers use its mobile payment service, Apply Pay, to make purchases instantly and pay for them in installments over time.

With “Apple Pay Letter,” users have the option to split purchases into four payments made over six weeks. They will not be charged any interest or fees, the company said in a statement announcing the new feature on Tuesday. Users can apply for “Buy Now Later” loans of $50 to $1,000 made through Apple Financing, which can be used for online and in-app purchases at any retailer that accepts Apple Pay.

Currently, “Apply Later” is only available to select users. The company plans to roll out the feature more widely in the coming months, Apple said.

apple

According to a Lending Tree survey, more than 40% of Americans have used “buy now, pay later” services.

While Apple claims the feature was designed with “users’ financial health in mind,” research shows that Many Americans struggle Buy now, pay later loans, which have become more popular with rising inflation.

The loans are designed to encourage consumers to spend and borrow more, and users have to pay fees if they miss a payment, which can cause them to accumulate more debt.

In 2021, buy-now, pay-later loans will total $24 billion, up from $2 billion in 2019, according to a CFPB report. The payment option has become ubiquitous in stores and online, forcing regulators to play catch-up. At the same time, the agency has seen a steady increase in the percentage of defaulting borrowers.

Trending news

Thanks for reading CBS News.

Create your free account or login

For more features.