This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The Federal Reserve’s statement on Wednesday was boring. The press conference that followed seemed boring. The market reaction to the presser was not boring. A comment on that, and some thoughts on the meaning of value, below.

Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Jay Powell does not know what is going to happen

Fed chair Jay Powell said nothing new on Wednesday. He signalled a March rise, as expected, and talked through some familiar principles for trimming the Fed’s balance sheet. But there was, maybe, something new about his tone in comments like this:

I would say — and this view is widely held on the [Federal Open Market] Committee — that both sides of the mandate are calling for us to move steadily away from the very highly accommodative policies we put in place during the [pandemic].

Most FOMC participants agree that labour market conditions are consistent with maximum employment, in the sense of the highest level of employment that is consistent with price stability — and that is my personal view . . .

I think there is quite a bit of room to raise interest rates without threatening the labour market.

Powell’s micro-smidgen of tonal hawkery — as well as his refusal to rule out more aggressive hikes — was enough to make stocks, which had rallied earlier, dip (they rebounded to end the day nearly flat). Bond yields bounced too (labels show yield increases in basis points):

Mr Market now expects four quarter-point rate increases by year’s end, with even odds on a fifth increase (data from Bloomberg):

Maybe. But we think the market is reading tea leaves that haven’t been brewed yet. In his briefing, Powell emphasised again and again that the Fed would be “nimble”, adapting policy to fit the economy:

It is not possible to predict with much confidence exactly what path for our policy rate is going to prove appropriate. So at this time, we haven’t made any decisions about the path of policy, and I stress again that we’ll be humble and nimble. We’re going to have to navigate cross-currents and actually two-sided risks now. What I’ll say is that we’re going to be led by the incoming data and the evolving outlook.

This kind of Fed-speak sounds mundane, and so it’s easy to ignore. But taken seriously, it is a bracing admission that the Fed has little idea where growth or inflation are heading. There are too many contingencies. Powell has no better idea than anyone else of when supply conditions or demand for goods over services will normalise. Nor can he divine the next virus variant’s virulence.

His hesitation is wise. As critics demand that the Fed raises rates to restore its credibility, Powell is winking hawkishly at markets while keeping his powder dry. The real risk to the central bank’s credibility is trying to jawbone the market before the data is in — and then getting wrongfooted by a fast-changing economy.

Jittery markets want guidance from the Fed. But for now, the central bank can only offer honesty. Investors’ best recourse is to keep a close watch on upcoming data releases. The Fed will be watching, too. (Ethan Wu)

The value rotation is about confidence, not maths

You will be forgiven for not seeing immediately that this chart could depict a seismic shift in market dynamics:

It shows US value stocks outperforming growth stocks by a solid margin — 10 per cent or so — over the past 12 months. That has hardly ever happened over the past 15 years or so, and it has people talking about whether the pandemic has ended the long reign of growth stocks.

As we have argued in this space with mind-numbing repetitiveness, the predominant theory about value’s recent resurgence is somewhere between an oversimplification and an outright error. The theory is that interest rates and duration are the key: as rates rise, the discount rate applied to stocks’ future cash flows rises, disproportionately depressing the value of equities that have a relatively high proportion of their cash flows far in the future — that is, growth stocks.

But if the (nascent) rotation towards growth is not all about interest rates, what is it about? Quantitative strategist Yin Luo of Wolfe Research says fundamentals, trend following, hedge fund positioning, and the current stage of the economic cycle all favour value:

The outperformance of value over growth in the past 12 months is only partially due to rising interest rates (and rising inflation). The fundamental characteristics of value stocks have also improved considerably — they are more profitable, with stronger sellside analyst sentiment. Furthermore, the [market] trend of value factors has also improved (given value’s recent outperformance [that] is a self-fulfilling prophecy). Next, hedge funds on average have become more bullish on value stocks . . . lastly, on the macro side, value style also tends to outperform growth in the mid-stage of an economic recovery.

Historically, Luo says, value does not always outperform growth when rates rise. He’s right about that, as a 30-year chart of the value/growth performance ratio and annual changes in interest rates shows:

There have been loads of rate jumps that have done nothing for value investors. Maybe, then, we should take a step back and ask, what is “value” in this context?

Clifford Sosin, who manages $2bn for CAS Investment Partners and describes himself as a “neo-value” investor, offers this summary:

Value guys look the asset and ask, ‘how much cash will it generate over time?’ The others look at it and say ‘how much will the next person be willing to pay for it?’

The core concept here is prediction. Value guys want to see cash flows they can predict and — this is the important bit — they tend to be very modest about how much they can predict. Patrick Kaser, head of the fundamental equity team and Brandywine Global, says modesty is exactly what some growth investors lack. They believe they can predict which companies will “disrupt” the economy in the future:

The thing behind [growth’s long period of outperformance] is the belief that there are a lot more disrupters that history would suggest is likely. And there are a lot of people who have convinced themselves, against all odds, that they are good forecasters of who the disrupters will be.

What is happening now, he says, is that predictive confidence is declining:

If you step back as an investor and say, ‘I am buying a business,’ what a value investor says is, ‘I want to pay a reasonable price for that business, with a margin of safety.’ What the market has said [until recently] is that we are not going to put in that margin of safety, and we are going to put a high probability on parabolic success.

Ben Inker, co-head of asset allocation at GMO, also links the concept of value with modesty about what can be predicted, and gives a psychological explanation of why rising rates encourage that modesty:

If you think about what investors have been doing, it’s been all about hope and dreams. People have been looking for life-changing returns . . . in a world where people are interested in lottery tickets, they are not going to be interested in value investing. The thing about higher interest rates is they do get you thinking about what kind of return you can get that does not depend on making a better prediction than the next guy about what the future may bring.

So is the shift to value for real this time? We’ve had plenty of false springs for value over the past 10 years. Consistent with the predictive modesty preached by the value investors we spoke to, all of them said there was just no way to tell. But Matt McLennan, of First Eagle’s global value team, made two useful points.

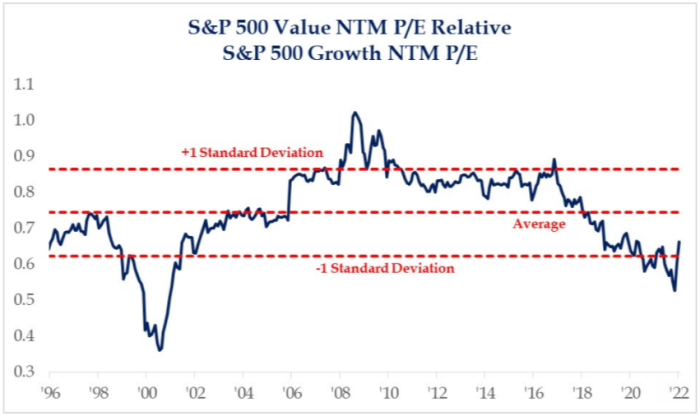

The first is that two sectors that have long attracted value investors, banks and real assets (from Reits to gold miners), benefit from rising rates and rising inflation, respectively. So there is a link to the current rate environment, though not via the nonsense duration link. His second point is that by historical standards, value remains very cheap relative to growth, and so value’s outperformance trend may have more room to run. This chart from Ryan Grabinski of Strategas makes his point well:

Value stocks are often referred to as “cheap”, but they are particularly cheap today.

One good read

Investment choices and music choices may be linked.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here